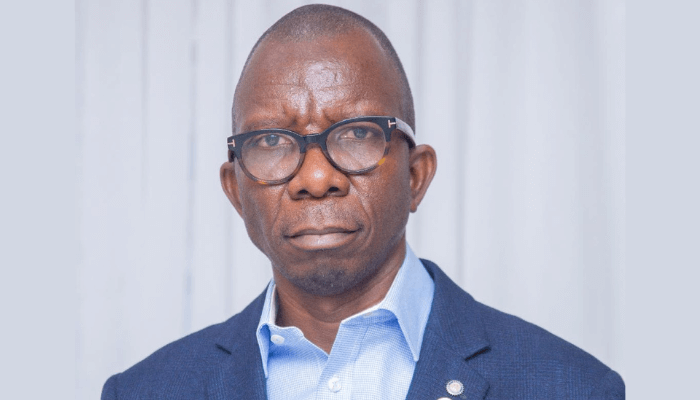

Tayo Adekoya, the MD/CEO of Adept Lessor Limited, is at the forefront of Nigeria’s growing asset finance leasing industry. As the sector gains traction, Adekoya sheds light on its potential, challenges, and the role Adept Lessor is playing in shaping the future of asset financing in the country.

The State of Finance Leasing in Nigeria

Nigeria’s finance leasing industry has experienced steady growth, driven by increased awareness and financial literacy programs aimed at educating individuals and businesses on asset financing. Despite this progress, the sector remains largely untapped, offering immense opportunities for expansion.

Over the past decade, the Nigerian leasing industry has consistently recorded growth in business transactions. According to the Equipment Leasing Association of Nigeria (ELAN), the industry demonstrated resilience even during economic downturns. After a sharp decline in growth from 14.5% in 2019 to 4.3% in 2020 due to the COVID-19 pandemic, it rebounded with a remarkable 28.65% growth in 2021. With continued awareness and strategic initiatives, the sector is poised for even greater expansion.

Why the Leasing Market Remains Largely Untapped

The demand for asset acquisition in Nigeria is constantly rising as entrepreneurs and business owners seek financing solutions to scale their operations. However, many are still unaware of how finance leasing can help them acquire assets without significant upfront capital. This gap presents a massive opportunity for leasing companies to bridge the divide and introduce tailored financial solutions.

Policy and Industry Focus for Growth

ELAN, the industry’s regulatory body, has been working to strengthen the sector through increased awareness campaigns and streamlined onboarding processes for new entrants. Training programs are also being introduced to promote ethical business practices and improve service delivery. These efforts are critical in positioning the leasing market as a key driver of economic growth in Nigeria.

Key Challenges in the Finance Leasing Industry

One of the biggest hurdles facing the finance leasing sector is the availability of consistent funding to meet the growing demand for asset financing. While there has been notable progress, securing adequate funds to support individuals and businesses remains a challenge. However, strong relationships with financial institutions, angel investors, and other funding bodies have helped players like Adept Lessor navigate these challenges effectively.

Adept Lessor’s Approach to Transforming the Market

Adept Lessor is committed to delivering value-driven solutions in the leasing space. At the heart of the company’s mission is a customer-centric approach that prioritizes integrity, trust, and innovation.

By introducing attractive leasing products and forging strategic partnerships with reputable organizations, Adept Lessor is deepening market penetration and making asset financing more accessible. The company has also embraced data-driven decision-making, using insights to shape investment choices and provide clients with tailored financial solutions.

One of its key innovations is a flexible car leasing and financing model that allows customers to purchase vehicles and pay in manageable installments. This approach has proven successful over the past two years, changing the narrative around car leasing in Nigeria. Under Adekoya’s leadership, Adept Lessor has emerged as a leader in the industry, earning accolades such as the Gold Award for Customer Excellence at the Africa Brands Awards in 2022.

Leveraging Finance Leasing as an Investment Opportunity

Investments drive economic growth, and the finance leasing sector presents a promising opportunity for investors. However, understanding the industry landscape and conducting thorough research is crucial before committing capital. With the right knowledge, investors can tap into a growing market that plays a vital role in business sustainability and expansion.

Hedging Against Inflation with Smart Financial Decisions

Inflation is an economic reality, but individuals and businesses can mitigate its impact by making informed financial choices. Investing in appreciating assets like real estate or businesses that can adjust pricing in response to inflationary pressures are viable strategies. Financial literacy and proactive decision-making are key to safeguarding wealth in uncertain economic conditions.

Giving Back: A Commitment to Societal Growth

For Adekoya, corporate social responsibility is more than just a business obligation—it’s a personal commitment. Through the Tayo Adekoya Foundation, he focuses on empowering individuals and communities in education, entrepreneurship, and leadership development.

His initiatives include mentorship programs, scholarships, and community development projects aimed at fostering long-term impact. Additionally, he runs a masterclass series that equips aspiring entrepreneurs with essential business and financial management skills, helping them navigate their journeys more effectively.

Who is Adetayo Adekoya?

Adetayo Adekoya is the CEO of Adept Lessor Limited, a company he has successfully steered to become one of Nigeria’s leading asset finance leasing firms. With over two decades of industry experience, he has played a pivotal role in shaping the sector, specializing in corporate and personal finance leasing, lease documentation, pricing, and portfolio management.

Under his leadership, Adept Lessor has received numerous industry recognitions, including ranking among BusinessDay’s Top 100 Fastest Growing SMEs in Nigeria in 2022. His vision remains clear: to drive financial inclusion through innovative leasing solutions while fostering economic growth in Nigeria.

As the finance leasing industry continues to evolve, Adekoya and his team at Adept Lessor remain dedicated to unlocking its full potential—one smart financial solution at a time.

Leave a Reply