If you’ve applied for a NIRSAL Microfinance Bank (NMFB) loan, staying updated on your application status, disbursement, and repayment details is crucial. Fortunately, NMFB provides an easy way to check your loan status using your Bank Verification Number (BVN). This guide walks you through the process step by step, ensuring you can track your loan and manage your finances effectively.

Key Takeaways

- You can check your NIRSAL loan status online by entering your BVN on the NMFB portal.

- A BVN is required to apply for or track a NIRSAL loan. If you don’t have one, you can obtain it at any Nigerian bank.

- NIRSAL offers various loan types, including Non-Interest Targeted Credit Facility (TCF) and AGSMEIS loans, designed to support businesses and households.

How to Check Your NIRSAL Loan Status with BVN

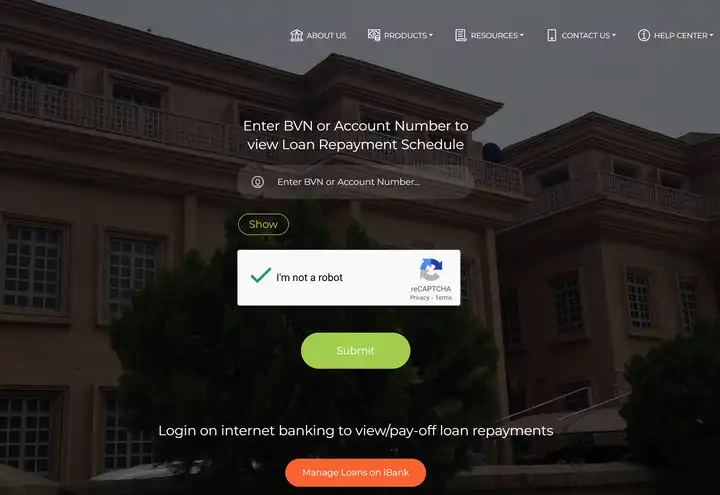

To check your loan status, follow these steps:

- Visit the NIRSAL Microfinance Bank portal – Open the official NMFB website on your browser.

- Enter your BVN – Input your 11-digit Bank Verification Number in the designated field.

- Click “Validate BVN” – This will pull up details about your loan status, whether it’s pending, approved, or disbursed.

Once validated, you’ll have access to real-time updates regarding your application progress, loan amount, and repayment schedule.

How to Register and Log In to the NIRSAL Portal

To access loan details and other services, you need an account on the NMFB portal. If you haven’t registered yet, follow these steps:

- Visit a NIRSAL branch – Registration requires an in-person visit.

- Provide your details – Submit your name, email, phone number, and BVN.

- Log in using your credentials – Once registered, you can log in anytime with your email or phone number and password.

After logging in, you can track your loan, view repayment details, and access other financial services.

NIRSAL Loan Application Process and Requirements

You can apply for a NIRSAL loan through two methods:

1. Online Application

- Visit the official NMFB website.

- Complete the online application form with personal and business details.

- Submit the form and wait for loan approval.

2. In-Person Application

- Visit any NIRSAL branch.

- Fill out a physical application form and submit it with the required documents.

Loan Approval and Disbursement Process

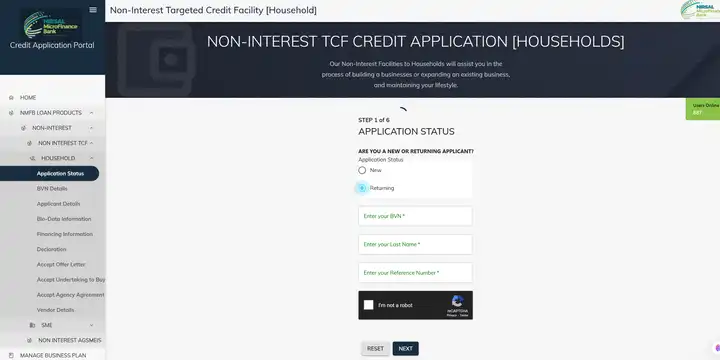

If your application is approved, you’ll need to:

- Generate and accept the Offer Letter and Undertaking to Buy Agreement.

- Provide details of the assets or equipment to be financed.

- Submit valid invoices for all listed items.

- Wait for funds to be disbursed directly to vendors for asset purchase.

- After delivery, sign the Murabahah Agreement to finalize the contract.

Returning applicants can log in using their BVN, last name, and reference number to check their loan progress.

Types of NIRSAL Loans and Their Features

Non-Interest Targeted Credit Facility (TCF-NI)

This loan is designed to support businesses and households affected by economic challenges, such as the COVID-19 pandemic.

Household Facility

- Maximum Loan Amount: ₦500,000

- Profit Margin: 9% per annum

- Repayment Period: 36 months

SME Facility

- Maximum Loan Amount: ₦750,000

- Profit Margin: 9% per annum

- Repayment Period: 36 months

AGSMEIS Loan (Non-Interest)

The Agri-Business, Small and Medium Enterprise Investment Scheme (AGSMEIS) supports entrepreneurs in agriculture and small businesses. This loan follows Islamic finance principles, such as Murabahah (cost-plus financing) and Ijarah (leasing).

- Financing Limit: Up to ₦10,000,000

- Tenure: Up to 7 years (depending on project type)

- Moratorium: 6 months on profit and 18 months on principal repayment

How to Retrieve Your NMFB Account Number

Your NMFB account number is a unique 7 to 12-digit identifier required for loan management. If you forget it, follow these steps:

- Log in to the NMFB Internet Banking platform.

- Navigate to your profile or account section.

- Your account number will be displayed along with other personal details.

How to Check Your Loan Balance

To monitor your remaining loan balance and repayment schedule:

- Log in to NMFB iBank using your credentials.

- Go to the Loan section.

- View your outstanding balance, repayment schedule, and due dates.

Keeping track of your balance helps you avoid late payments and penalties.

How to Contact NIRSAL Microfinance Bank

If you encounter any issues while checking your loan status or need additional information, you can reach out to NMFB through the following channels:

- Physical Address: House 1, Plot 103/104, Monrovia Street, Wuse 2, Abuja

- Phone Numbers: +2349010026900, +2349010026907, +2349010026901, +2347041800003

- Email: [email protected]

- Facebook: @NirsalMFinanceBank

- Twitter (X): @NirsalMFB

Final Thoughts

Understanding how to check your NIRSAL loan status using your BVN ensures you stay informed about your loan progress, balance, and repayment plan. Whether you’re a new applicant or a returning borrower, following the right steps will help you track your finances with ease.

If you have any questions or issues, don’t hesitate to reach out to NMFB’s support team for assistance.

Disclaimer: This article is for informational purposes only. It does not serve as financial advice, and individuals should conduct their own research or consult with a financial expert before making any loan-related decisions.

Leave a Reply