Once praised as cutting-edge platforms for generating income, multi-level marketing (MLM) schemes are rapidly being exposed as fronts for widespread financial crime throughout Africa, with Nigeria emerging as a major hotspot.

Individuals and families are currently losing billions of naira as a result of these fraudulent activities, which are frequently orchestrated as genuine business endeavours or digital investments. Victims and marketers unsuspectingly and voluntarily help in spreading false promises due to greed and desperation. And this is adding to the already severe economic suffering on the continent, especially in Nigeria.

The MLM concept was first presented as a network-based retail business in Africa, but it has since evolved into a more nefarious one. Today’s scammers advertise “digital investments,” “crypto packages,” or “automated trading bots,” promising enormous profits with little to no risk, in contrast to classic multi-level marketing organizations that sell physical goods like cosmetics or health items.

A burgeoning youth population, economic despair, and the emergence of digital platforms have made Nigeria an ideal place for exploitation. These days, tech-savvy scammers operate on platforms like LinkedIn, Telegram, and WhatsApp, evading laws and quickly disseminating false information.

“I have stated on multiple occasions that the only people who benefit are the thieves who set up these schemes and very few enablers that advertise it here (a WhatsApp group) by raking up referral bonuses,” said an old member of the “Investment Opportunities 2” WhatsApp group, who wishes to remain anonymous. STOP ENABLING THESE THIEVES, PLEASE! QUIT PROMOTING PONZI SCHEMES! We investors are the only ones who lose out here. The old victim exclaims, “These guys are really cashing out, balling, and buying cars with your sweats,” and was later kicked out of the group by the administrator.

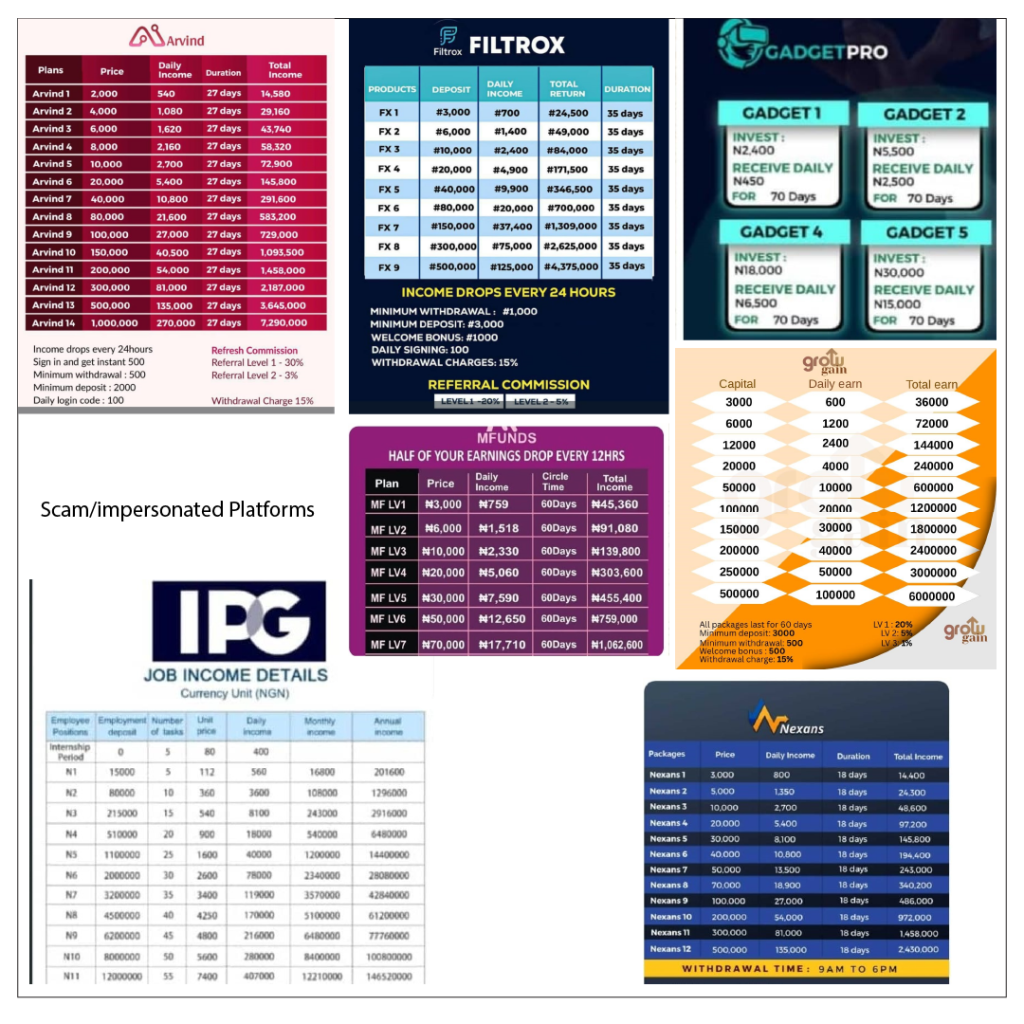

Mothercloud News can confirm the identity of some fake/impersonated brands as follows:

“MFunds,” “Z-Mexci,” “Ethereal,” “Squads games,” “GadgetPro,” “Nexans/Nexxams,” “Spare Parts Mall,” “Nvidia/invsds,” “Tbills,” “WPP/wpp0909,” “Portland,” “Arvind,” “Filtrox,” and “Grow Gain,” are the ongoing fraud websites currently operating in Nigeria. These platforms are typically fraudulent multilevel marketing schemes enticing participants by guaranteeing rewards on a purported investment. With the promise of additional awards, team rankings, and accelerated withdrawal perks, members are then encouraged to bring on new investors.

The Emerging Trend: The recent alarming trend emerging is the way old victims are helping these faceless perpetrators spread their tentacles by creating subgroups consisting of downline participants, different from the primary medium, made possible through sharing invites with old and new victims. The target here is the attempt to outsmart the fraudsters by using contributed funds from several members interested in investing as individuals and sharing the earnings according to the percentage of capital contributed.

One member of the “Young millionaires club” WhatsApp group, who wished to remain anonymous, disclosed the following announcement during our investigations:

“We’re excited to introduce a new plan to collaborate as a team. The idea is to pool our resources, invest in a platform, and aim for significant returns before any potential risks arise. Once we’ve recovered our capital and interest, we can move to the next investment opportunity,” he said in the group.

Frequently, money is exchanged, but no real goods or services are provided. A hallmark of a Ponzi scheme is that the system depends solely on getting old and new members to increase their rewards.

An example is the “Exro Technologies” fraud. The website identified itself as Exro Technologies and debuted in Nigeria at the beginning of 2025, claiming to be a multinational tech company that provides prospects for passive income through AI trading. Deposits as low as ₦5,000 were needed, and participants had to refer others to access “higher earnings”. The plan failed less than a week later, stealing more than ₦400 million in savings from the populace.

To finance these schemes, people borrowed money from individuals and loan companies, invested retirement funds, and even sacrificed their children’s school fees. Eventually, victims are mostly too embarrassed and reluctant to report the loss when the fraudulent scheme crashes.

The Securities and Exchange Commission (SEC) of Nigeria has cautioned against unregistered investment schemes on numerous occasions. However, because these networks are digital and decentralized, enforcement is still lacking. And those who volunteer to get involved with the fraud culprits continue to bring onboard unsuspecting individuals.

Although the Economic and Financial Crimes Commission (EFCC) has looked into scores of Ponzi schemes connected to multilevel marketing, officials acknowledge that the majority of these schemes shut down before an investigation can be conducted.

Due to the high unemployment rate, particularly among young people, many Nigerians resort to multilevel marketing platforms in a desperate attempt to make ends meet. Victims suffer severe emotional harm in addition to monetary loss. Those who lose their life savings to these scams are more likely to experience anxiety, depression, and even suicide, according to mental health specialists.

In order to alert the public, governments in Africa are now being encouraged to enact stronger regulations governing digital investments, create centralized registries of authorized operators, and support financial literacy initiatives. Despite delayed progress, there are reports that the National Information Technology Development Agency (NITDA), SEC, and Central Bank of Nigeria are forming a multi-agency task force.

Without a strong security system in place, fraudulent multi-level marketing schemes are likely to grow in number as poverty, inflation, and digital access collide throughout Africa. Nigeria, a nation with both potential and danger, is at the forefront of this escalating crisis between exploitation and optimism.

Notify the EFCC or SEC Nigeria right away if you or someone you know has fallen victim to an MLM scam.

Leave a Reply